When it comes to running a successful business, keeping track of your finances is paramount. Understanding the basics of bookkeeping is essential for any business owner, regardless of the size or nature of their enterprise. Bookkeeping provides a clear picture of your financial health, helps you make informed decisions, and ensures compliance with tax regulations. In this blog post, we will delve into the fundamentals of bookkeeping and explain why it is crucial for the success and sustainability of your business. What is Bookkeeping? Bookkeeping refers to the systematic recording, organizing, and tracking of financial transactions within a business. It involves maintaining accurate and up-to-date records of all income, expenses, assets, and liabilities. The primary goal of bookkeeping is to create a comprehensive and transparent financial overview that allows business owners to monitor their financial performance and make sound financial decisions.

Key Bookkeeping Concepts:

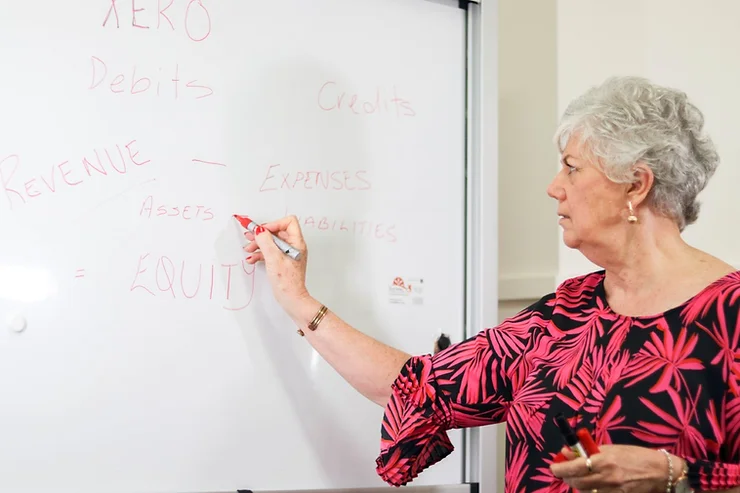

1. Double-Entry System: Bookkeeping relies on the double-entry system, where every transaction is recorded in at least two accounts. These entries are known as debits and credits. Therefore, for every debit there must be a corresponding credit. This system ensures accuracy and maintains the balance between assets, liabilities, and equity.

2. Chart of Accounts: A chart of accounts is a list of all the accounts used by a business to record its financial transactions. Whilst there is a systemised order for these accounts the number that you will use in your business depends on the size and complexity of your business model.

3. General Ledger: The general ledger contains all the individual accounts and their corresponding transactions. It serves as a comprehensive record of a company’s financial activities.

4. Debits and Credits: In bookkeeping, debits and credits are used to record increases or decreases in accounts. Understanding how debits and credits work is crucial for maintaining accurate financial records.

Importance of Bookkeeping for Your Business:

1. Financial Decision-Making: Accurate bookkeeping provides valuable financial insights, into the performance of your business. This then allows you to make informed decisions about pricing, budgeting, investments, and cost control. Through accurate bookkeeping, many reports can be used to provide sound financial information on which to base your decisions.

2. Compliance and Tax Obligations: Compliance and taxation reporting and obligations in Australia are complex. Professional Bookkeepers will assist you in having accurate financial data. They will also facilitate the reporting digitally, so you avoid penalties and legal issues.

3. Business Performance Assessment: Bookkeeping allows you to assess the financial health and performance of your business. Regularly reviewing financial statements and reports helps identify trends, patterns, and areas that need attention. It enables you to monitor profitability, cash flow, and solvency, thereby facilitating proactive decision-making.

4. Facilitating Loans and Investment Opportunities: When seeking external funding, such as loans or investment, accurate and well-organized financial records are critical to making to achieving your goals. Potential lenders and investors will require not only historical financial data but will also want to see up to date data to evaluate your business’s ongoing viability, stability and continuing trends. Accurate and reliable bookkeeping gives lenders instils confidence and increases your potential of securing the funding you are seeking.

5. Future Planning and Forecasting: By maintaining a thorough record of your financial transactions, you can analyse historical data to forecast future trends and plan accordingly. This includes budgeting, setting financial goals, and developing strategies to achieve them. Bookkeeping equips you with the necessary information to make realistic projections and guide your business toward success.

Bookkeeping is the foundation of sound financial management for any business. By understanding the basics and implementing effective bookkeeping practices, you can gain valuable insights into your business’s financial performance, make informed decisions, ensure compliance with tax regulations, and confidently plan for the future.